What is the Customs Code for Acacia Wood Cutting Boards?

For importers, exporters, and even curious consumers, knowing the correct customs or HS (Harmonized System) code for Acacia wood cutting boards is essential. It determines not only how the product is categorized internationally but also affects duties, taxes, and compliance with food safety regulations.

Standard HS Code for Wooden Cutting Boards

In most global trade systems, wooden cutting boards—including those made from Acacia—fall under the HS code:

4419.00 – “Tableware and kitchenware, of wood”

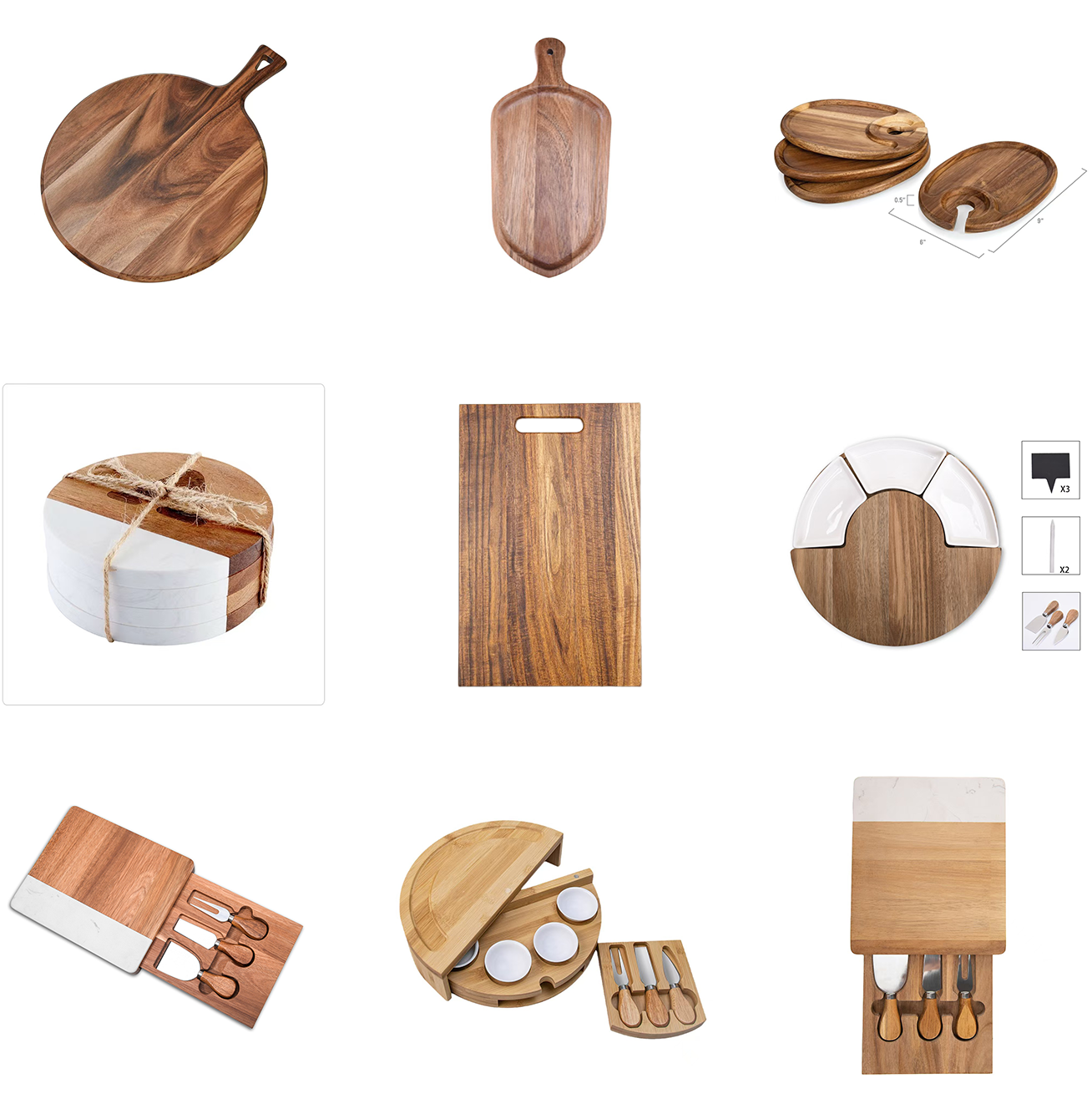

This classification includes chopping boards, cheese boards, trays, breadboards, and other wooden kitchenware intended for direct food contact. For example, products such as the Safe for food custom Acacia wood BBQ chopping board and FDA approved on-demand production Acacia wood Cheese platter board would be declared under this code.

When More Detail is Needed

Depending on the country and the specific use or finish, sub-codes may be used. For instance:

If the board is a Food-safe silicone configurable Acacia wood Prep board, the addition of silicone may require declaration under composite goods.

In some jurisdictions, Zero contaminants configurable Acacia wood Serving board might require extra documentation proving it's free from preservatives or harmful substances.

Why Classification Matters

Incorrect HS codes can:

A Bio-safe custom Acacia wood Meat carving board, for instance, must be declared appropriately if it contains antimicrobial coatings or has been treated to meet FDA or EU food safety standards.

Food Safety Compliance and Documentation

Many importers are now required to provide:

Especially for FDA approved or bio-safe boards, customs may also ask for testing reports, certificates of analysis, or materials origin verification.

If you’re dealing with the international trade of Acacia wood cutting boards, always confirm the correct customs code—typically 4419.00—and ensure the board meets all destination-country food contact regulations. This will ensure smooth clearance, fair duties, and consumer safety.